Tax Management

Do you feel like you are paying too much tax each year? You probably are!

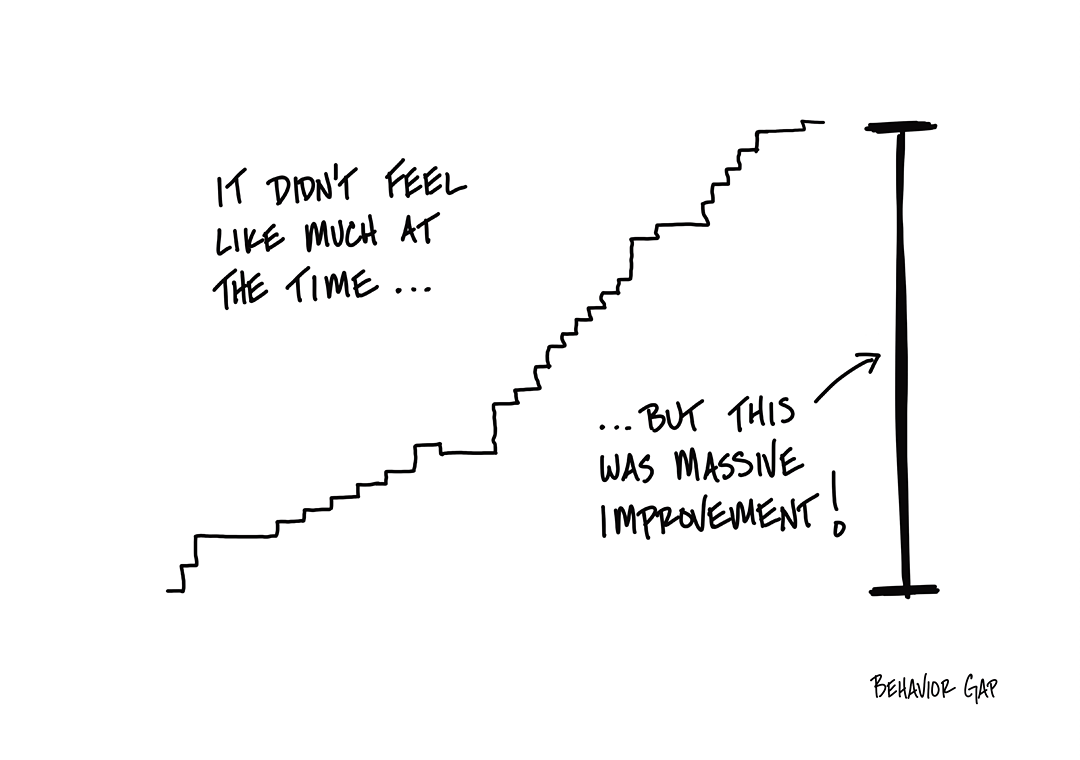

Smart tax planning means keeping more of your hard-earned money where it belongs, in your pocket.

There are tax implications to each and every element of your integrated wealth plan, and Jones Private Client can develop customized strategies designed to minimize the tax burden on your income and investments.

There are tax implications to each and every element of your integrated wealth plan, and Jones Private Client can develop customized strategies designed to minimize the tax burden on your income and investments.

Remember: it’s not so much what you make that counts. It’s what you keep!

Charitable Giving

Including charitable giving as part of your overall wealth plan can have many benefits for you, your heirs, and those in your local community or in countries across the world.

When properly integrated, charitable giving can provide a tax-efficient means for you to transfer your wealth while supporting a cause that you believe in.

To ensure that your planned giving has the greatest impact, whether it’s a significant gift to a favourite charity or the establishment of a foundation, we have access to the tax, legal, and estate planning professionals who will help make your philanthropic wishes a reality.

Stephen Jones CPA, CA, CFP®

Senior Financial Advisor

Catherine Jones BBM, CDFA, CFP®

Senior Financial Advisor

Lynley Schwartzentruber BBA, CFP®

Senior Financial Advisor

Mutual fund products, investment services and recommendations are offered through Assante Financial Management Ltd. Insurance products and services are provided through Assante Estate and Insurance Services Inc. Wealth planning services may be provided by an accredited Assante advisor or through CI Assante Private Client, a division of CI Private Counsel LP, or a non-affiliated third party.

Assante Financial Management Ltd. is a member of the Mutual Fund Dealers Association of Canada and MFDA Investor Protection Corporation (excluding Quebec).

© 2022 CI Assante Wealth Management. All Rights Reserved.